What happens to us amateur seafarers after Brexit, when the UK eventually withdraws from the European Union?

What happens to us amateur seafarers when the UK eventually withdraws from the European Union? Will Brexit, as it’s known, be a plus or a negative?

There will be few readers who remember crossing the English Channel in the 1950s. It was a wonderful period. You were responsible for yourself and if you drowned, you drowned. Arriving in France or Belgium really was travelling abroad.

Ports had a different smell then, a mixture of strong cigarette smoke, floating fish scales, guts and spilt diesel.

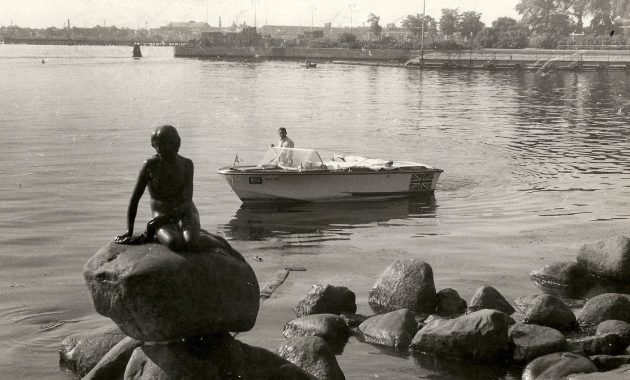

Ray in Scandinavia with his 18ft (5.4m) open runabout in 1964

Moorings cost nothing in Calais and Boulogne. Although the environmental changes experienced today in such places are nothing whatsoever to do with the EU, there is one aspect of ‘going foreign’ that no longer exists: to be woken up after a rough crossing by the local ship chandler banging on the cabin coach roof pushing his list of duty-free stores.

None of us knows the positives and negatives of our forthcoming exit from the EU but I do know whenever I pass through a British airport I can purchase duty-free goods – particularly spirits and tobacco – providing I hold a ticket to a non-EU destination. Therefore, if we leave the community with a clean break, the same will obviously apply to all taxable goods.

Perhaps equally important is that there was always was a tremendous difference in the cost of duty-free items bought at airports and aboard cross channel ferries compared to prices offered by ships chandlers in France and Belgium.

Ray passes The Little Mermaid, Copenhagen

Duty-free or bonded stores were not available from UK ports for private craft below 50 registered tonnes.

Those that did qualify had to be leaving British territorial waters and be fitted with an approved, bonded store locker which could be sealed by customs officers ensuring nothing was consumed in port. Such rules didn’t apply on the continent. There, it was a free-for-all with unbelievably low prices compared to ferries and airports operating in the UK.

As long as a foreign visiting boat and its crew were leaving the arrival port within 24 hours, the chandler offered an Aladdin’s Cave of wines, spirits, tobacco, perfume, watches and all manner of tax-free luxuries.

Although I’m sure local regulations did exist, the size of craft seemed of little importance.

Ray Bulman

During one, 1,000-mile trip to Scandinavia aboard an 18ft (5.4m) open runabout in 1964 (MBY Sept 20, 1968) I was sold 10 bottles of duty-free whisky to sweeten dealings with any stubborn official along the route, plus 50 cigars for my partner, Geoff, by an agent of the North Sea Yacht Club in Ostend. No questions asked.

And talking about duty-free, what about the diesel derogation taken away from British pleasure boat owners by the EU in Brussels? It pushed up the cost of fuel considerably, in some cases reducing long-distance cruising plans.

I’m sure that its reintroduction is asking for too much, but EU taxes and laws, particularly those centred on health and safety, have certainly clipped many wings.

The return of duty-free allowances would have another benefit which I’m sure few have considered: duty payable has to be regulated, particularly by those who try to take advantages over the approved limit of free imports.

My experiences ‘going foreign’ in the 1950s and 1960s were always governed by the reception I would receive when re-entering British waters and ports.

One was not entitled to go ashore before a Water Guard (the original title of customs officers) had given his clearance.

This centred on the duty-free goods purchased abroad. To say they were tough would be an understatement. If the Water Guard had any suspicion of smuggling he would call his colleagues and rummage through the boat, removing cabin panelling to expose any areas where goods could be hidden. It paid to be honest.

At a recent talk by the UK Border Agency in the Island Sailing Club, the speaker confirmed that there are only two cutters guarding 7,000 miles of UK coastline. He asked all members to keep a close watch for illegal immigrants and provided a list of agency contacts to call should any be spotted by the boating community.

In the old days of duty-free and import controls, the British coastline was thick with customs cutters. There were at least three operating out of Gravesend, patrolling the Thames estuary, plus a couple more covering the upper tideway up to the Pool of London. Others ports along the English Channel were also heavily patrolled by customs cutters.

Bringing back duty-free allowances for goods purchased in Europe would surely be doing the UK Border Agency a big favour.

Customs cutters on the look-out for smugglers could also keep a good look out for other illegal activities off our shores.

I eagerly await Article 50 next March anticipating the positives and the negatives. Here’s to a slug of cheap booze…

RYA raise concerns over e-Borders

Is it applicable to leisure boaters?

Cocaine worth £300m found on motorboat in Southampton

The UK’s biggest ever seizure of cocaine has been found on board a Dutch-registered motorboat in Southampton, the Home Office

RYA challenges ‘stop and search’ powers of cutters

Royal Yachting Association acts after a number of its members complained of being stopped and searched in UK waters by